Does the company you founded have a written mission statement and the steps required to achieve it? If you are running a successful startup, the answer is most likely yes.

Now be honest, do you have a similarly written plan for your personal finances? Have you taken a close look at where you are today, what you are spending now, and how your financial plan will determine your future lifestyle?

The truth is that most entrepreneurs simply do not have time to manage their personal finances. You are probably confident that a life-changing sum may be coming your way upon exit. But with all the work needed to reach this goal – long hours, personal investments, overseeing your team – it is hard to find any time to manage and prepare for your financial success.

Founders like you face a unique set of challenges. It is no surprise that many find themselves at the cusp of realizing their dream of a liquidity event only to realize that, “wait… I have not prepared for this at all!”

The good news is that you are not the first entrepreneur to come to the realization that planning your personal finances will lead to the lifestyle you want. Others have already experienced these challenges before you, leaving a framework of solutions we can apply to your specific needs.

Four Major Challenges: Time, Team, Tax, And Trust(S)

By applying the solutions covered in this guide you can: have more time, pay less tax, rely on a team of specialists, and trust that your legacy will be secured.

Here are four challenges faced by entrepreneurs and impactful solutions.

CHALLENGE #1: TIME

One of the modern facts of life is that nobody has any time. In theory, new technology should help us save time. But better technology means higher expectations, and higher expectations create more work. This is even more true for a busy entrepreneur like yourself who is constantly at work building your company.

You can gain back control of time via one of the oldest technologies: your money. Imagine you could invest in a way that allowed you to wake up every morning and say: “I can do whatever I want today.” Personal financial planning gives you options. Retire early, build another company, live without financial stress; any of these goals can be achieved once you get started.

SOLUTION: YOUR FINANCIAL PLANNING RELATIONSHIP

The financial planning process begins by clarifying your goals with a financial planner. A good planner will learn about your values and aspirations. They will guide your progress and help bridge the gap between where you are financially and where you would like to be. You will no longer have the burden of second-guessing every financial decision; or the risk of not making any decisions at all.

For many entrepreneurs, the financial planning process begins by addressing three core needs:

- Liquidity – your cash flow needs to maintain or improve your current lifestyle

- Longevity – your ability to grow and protect assets from a successful exit with strategic tax and investment planning

- Legacy – your wish to improve the lives of others, such as family, friends or charity

Along the way, good financial planning will also help entrepreneurs manage equity compensation, stock diversification, risk tolerance, investing behavior, education planning, and even team building.

Financial planning will help you spend less time worrying about your money and more time on what’s important to you and your family. The playbook works, as it has for many others. The next step is to identify the right person to quarterback your team and execute.

READ MORE: What Does A Financial Advisor Really Do For You

CHALLENGE #2: TEAM

Most entrepreneurs are hyper-confident. You know how to build a business. Conviction in yourself and your abilities enables you to execute your vision. But while you may be skilled at constructing a company balance sheet, managing a personal balance sheet is daunting.

You probably could manage your own finances if you had the time, desire, and training. But the fact is, most successful entrepreneurs and professionals simply do not. It is also important to understand that investing is not all about skill. It is about emotion. And it is extremely hard for “anyone” to maintain objectivity and not make emotional decisions about their own money.

Just like you have done in your company, you will want to get the right team in place to meet these challenges.

SOLUTION: A FINANCIAL QUARTERBACK FOR YOUR TEAM

Think about building your personal financial team in the same way as you would with your company. You hire outstanding managers to own different parts of the business and increase its valuation. The only difference is we are working together to grow assets for you and your family.

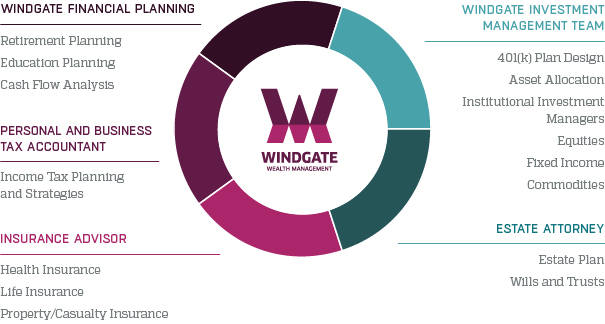

Key members on a personal financial team include an accountant, attorney, private banker, and insurance specialist. In many arrangements, these advisors work individually, placing an added burden on you to organize and delegate. That is why we recommend finding someone who can act as the quarterback to manage your team. This is the role of your Wealth Advisor, ideally a CERTIFIED FINANCIAL PLANNER™, who is also the individual that knows you and your goals best.

Your trusted advisor will sort through your financial needs and collaborate with your team, bringing all the specialists onto the same page and adding tremendous value.

READ MORE: How An Advisor Acts as A Quarterback to Your Team

CHALLENGE #3: TAXES

Imagine paying millions of dollars in tax upon a successful liquidation event from your company stock… only to learn that you did not have to. There is a saying that failing to plan is planning to fail. In no subject is that wisdom more appropriate to entrepreneurs than in taxes.

Entrepreneurs face multiple tax challenges in each stage of their financial journey. Early on, taxable income may be lower but future stock compensation must be strategically planned for. Following a liquidity event, larger pools of assets must be managed properly to minimize taxable gains and income. All along the way, solid deduction strategies can help lower a founder’s tax bill.

SOLUTION: A QUALIFIED SMALL BUSINESS STOCK (QSBS) CASE STUDY

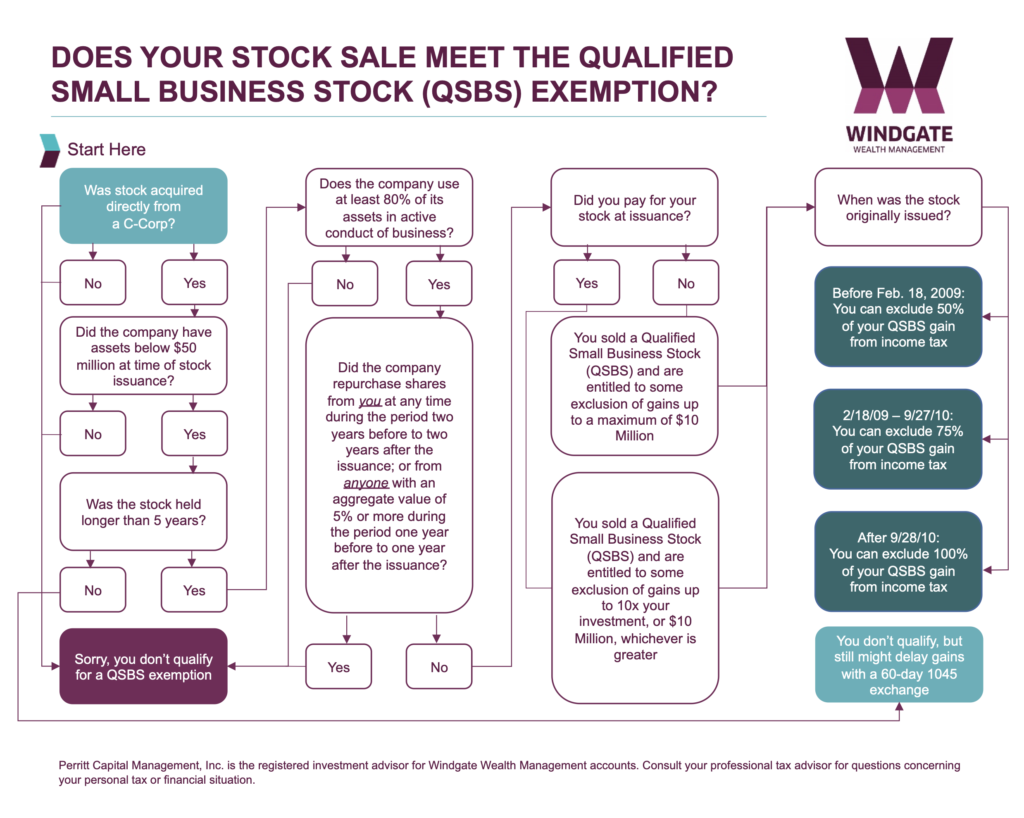

One tax planning strategy for entrepreneurs delivers the greatest impact of all: Qualified Small Business Stock planning. The QSBS exemption was created to reward risk-taking entrepreneurs and investors who create jobs with significant tax benefits.

The impact of these benefits is tremendous: QSBS exemption rules allow a company’s founders, employees, and early investors to exclude up to 100% of their capital gain on a sale of company stock, up to $10 million or 10x their initial investment.

While the tax-saving benefits of properly understanding QSBS can be measured in millions, QSBS can be difficult to plan for early on. As a company nears or begins contemplating an exit, making a QSBS analysis to plot out the right moves to reap the QSBS benefits makes obvious sense.

To help you navigate the maze of QSBS rules, we have created a flow chart for download: “Does Your Stock Sale Meet the Qualified Small Business Sock (QSBS) Exemption?” Follow the arrows to see if you qualify.

READ MORE: Entrepreneurs Guide to Qualified Small Business Stock

CHALLENGE #4 TRUST(S) AND ESTATE PLANNING

Many entrepreneurs are young and perhaps have yet to even consider basic estate planning. There is no need until wealth is achieved post-liquidity, the thinking commonly goes. This thinking is incorrect. In fact, it is before paper wealth turns into real wealth when estate planning techniques can be the most powerful to preserve your family’s legacy.

An entrepreneur still building their company faces basic estate planning needs. Having a will and term insurance can mitigate financial disaster for a family in the unfortunate event of death before a company’s valuation has truly been executed. Estate planning is more than worst-case scenario planning, however. The real solutions to preserving a family’s legacy relate to planning for positive events.

SOLUTION: A GRANTOR RETAINED ANNUITY TRUST (GRAT) CASE STUDY

How you plan your estate will have a significant impact on how much your family must pay in taxes, especially if you own assets like company stock that you expect to appreciate substantially.

Currently, estates above $11.58 million held by an individual ($23.26 million for a married couple) are subject to federal estate tax. These limits will expire in 2026 down to approximately half of current levels. At a hefty Federal tax rate of 40%, and many states adding additional state tax, a substantial portion of a wealthy family’s assets are likely to go toward taxes rather than to their heirs

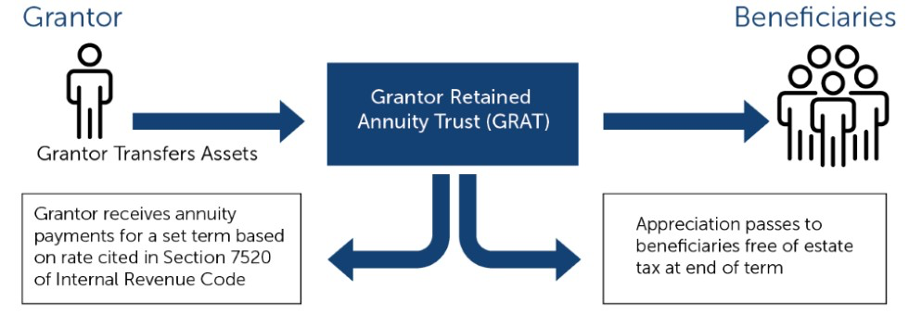

Strategic estate planning can allow entrepreneurs minimize estate tax and preserve family history. One example of this strategy is the creation of a Grantor Retained Annuity Trust, or GRAT.

A GRAT can freeze the taxable value of a business in its early stage, allowing you to limit future taxes. You can retain control and continue to receive cash flows upon exit.

Assets with a low current valuation compared to their expected future value (such as stock in a privately held firm) are particularly well suited to putting into a GRAT. This is because assets with the potential for great appreciation also have the potential for triggering large estate tax liabilities, and a GRAT allows you to bypass these future taxes.

READ MORE: Guide to GRATs – Estate Planning for Business Owners

Source: Kitces.com

IN CONCLUSION: YOUR OPPORTUNITY IS ALSO A RESPONSIBILITY

An entrepreneur does not have the security of the benefits that come along with being employed by a large company. What you do have is enormous financial upside. This opportunity comes with a responsibility to plan for future wealth. We commonly see entrepreneurs who are very successful in their professional lives yet are disappointed that their skills have not transferred to their personal finances.

The four main challenges of time, team, taxes and trust(s) are a natural hurdle for laser-focused entrepreneurs busy building their company. The good news is that there is a financial planning process that can help solve each of these challenges. Ultimately, we hope that financial planning will help you spend less time worrying about your money and more time on what’s important to you and your family.

ABOUT SEAN

Sean Condon, CFP is a wealth advisor with more than a decade of industry experience. He specializes in helping entrepreneurs build their person wealth and serving as the quarterback to a team of advisors. Taking an owner’s approach, Sean does his best to understand the many elements of his clients’ entrepreneurial journeys. He works in a technically competent and caring manner to reduce his clients’ anxiety about money issues and serves as a fiduciary by always putting his clients’ best interests first. Learn more about Sean by connecting with him on LinkedIn.

We are available to answer your questions, and we would enjoy the opportunity to see if we are a good fit for helping you reach your financial goals. You can reach us by calling (844) 377-4963 or emailing windgate@windgatewealth.com. You can also book an appointment online here.

Originally published here.

Join as an 1871 Early Stage Member.

Attend info sessionSubscribe to our ICYMI newsletter.

Share this post: